What does Medicare Supplement Plan K cover?

Medigap Plan K includes a yearly out-of-pocket limit of $5,560. This is huge because Original Medicare does not feature this benefit. So, if you were to reach out-of-pocket limit, Medigap Plan K may cover 100% of your Medicare-covered costs for the rest of the year.

Medicare Supplement Plan K also covers 50% of these expenses left over form Original Medicare:

-

Medicare Part A deductible

-

Medicare Part A hospice care coinsurance or copay

-

Skilled nursing facility care coinsurance

-

Medicare Part B copayment or coinsurance

-

First three pints of blood for a covered medical procedure

It does not cover part B's decudtible, excess charges, or a foreign travel emergency.

Lots of Medicare beneficiaries elect to purchase Plan K because of its lower premiums. If you do not make lots of trips to the doctor's office or hospital, it may be worth sharing some of the medical costs to save on monthly premiums.

A licensed Medicare agent with The Integrity Group can evaluate your situation for free and offer you a plan suited for your budget and medical needs.

What is the out-of-pocket maximum for Medigap Plan K?

The maximum out-of-pocket limit for Medigap plan K is $5,240 in 2019. This is the most you will have to pay out of your own pocket for Medicare-related expenses in a single year. If you were to ever hit this limit, your Medicare Supplement has to cover 100% of you Medicare-related expenses for the rest of the year. Because of the maximum, lots of Medicare beneficiaries will take the lower premiums offered by Plan K, knowing if they were to ever have a major health issue, the out-of-pocket limits offers a ceiling for their expenses.

Medicare Supplement Insurance Quotes

If you are interested in Medigap Plan K or any other Medicare Supplement Insurance plan, a licensed Medicare agent at The Integrity Group will be happy to shop for a good rate and offer consultation services so you feel comfortable in your decision on a policy.

Give us a call or submit your information for a free consultation today!

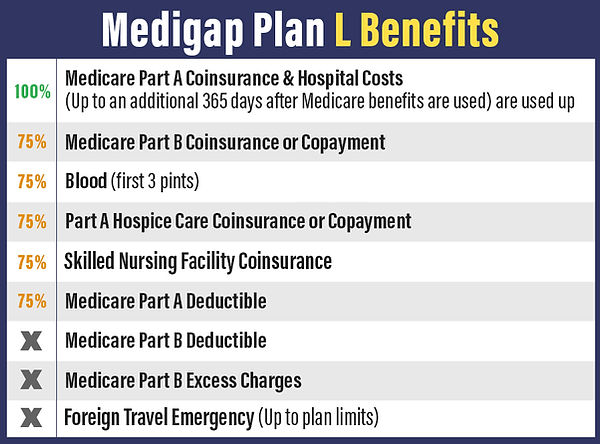

Medigap Plan L

Medigap Plan L not only covers a percentage of your out-of-pocket expenses left over by Original Medicare, but it also features an annual out-of-pocket maximum limit of $2,780 (in 2019).

Plan L is only one of two Medicare Supplement insurance policies that feature this out-of-pocket limit. Because of this popular feature and lower premiums, it may be worth the extra cost-sharing for Medicare beneficiaries.

What does Medigap Plan L cover?

Along with out-of-pocket maximum ($2,780 in 2019), Medicare Supplement Plan L also features 75% coverage of these benfits:

-

Medicare Part B coinsurance or copayment

-

Part A hospice care coinsurance or copayment

-

Medicare Part A deductible

-

First three pints of blood used in a medical procedure

-

Skilled nursing facility care coinsurance

It also covers 100% of Medicare Part A coinsurance and hospital costs up to one year after Original Medicare benefits are used up.

Because of the portion of cost-sharing, Medigap Plan L policies have lower premiums than other supplement plans, like Plan F, that cover all leftover costs by Original Medicare.

Medicare Supplement Plan L out-of-pocket costs

Under plan L, you'll pay some out-of-pocket costs assosciated with Medicare. These costs could be:

-

Medicare Part B deductible

-

Medicare Part B excess charges

-

Foreign travel emergency

You'll also pay 25% of your Original Medicare coinsurance or copayment costs, any skilled nursing facility coinsurance, Part A's deductible, and the first three pints of blood for a medical procedure.

Because of the cost-sharing, you'll pay lower premiums.

Medigap Plan L out-of-pocket maximum cap protection

Even though you do have some out-of-pocket expenses with Medicare Supplement Plan L, there is a maximum cap. Medicare sets this limit annually. In 2019, this limit is $2780. After you hit this limit, the Medicare Supplement Insurance plan has to pay 100% of your Medicare-related costs for the remainder of the year.

So, if covering some of your out-of-pocket Medicare expenses while still enjoying a lower premium sounds great to you, a licensed Medicare agent with The Integrity Group will be happy to help you.

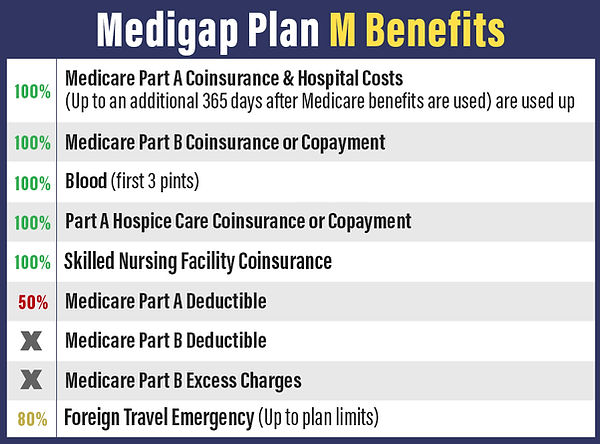

Medigap Plan M

Medigap plan M features similar benefits to other supplements, however it offers a lower premium in return for you paying part of your Original Medicare deductibles.

What does Medigap Plan M cover?

Medicare Supplement Plan M covers:

-

Medicare Part A hospital and coinsurance costs for up to a year after Original Medicare benefits are used up

-

Part A hospice care coinsurance and copayments

-

Medicare Part B coinsurance and copayments

-

First three pints of blood or a medical procedure

-

Skilled nursing facility care coinsurance

-

50% of Medicare Part A's deductible

-

80% of approved costs for foreign travel emergency (up to plan limits)

Medigap Plan M does not cover Medicare Plan B's deductible or excess charges. This helps keep your supplement plan's monthly premium low.

Medicare Supplement Plan M cost-sharing

By sharing 50% of the cost of Medicare Part A's deductible and paying Part B's deductible ($185 in 2019), you will notice that Medigap Plan M's premium is lower than some of the more comprehensive supplements. A licensed Medicare agent at The Integrity Group can help you decide what Medicare supplement would be better suited for your budget and healthcare needs.

Guaranteed Issue Medicare Supplement Insurance

If you are interested in enrolling in any Medigap policy, you should consider enrolling during your six-month open enrollment period. This window begins on the first day of the month that you are age 65 or over and enrolled in Medicare Part B. During this open enrollment, you are usually guaranteed eligible to enroll in any Medicare supplement insurance plan even if you have pre-existing health conditions. You will also not be charged a higher premium for any pre-existing health conditions. The only condition is you have to be enrolled in Original Medicare.

However, you are able to apply for a Medicare Supplement plan at any time. If you are interested in having your Medicare cost-sharing at least partially covered, or even fully covered, a licensed Medicare agent at The Integrity Group can help you find a plan that fits your budget and health care needs!

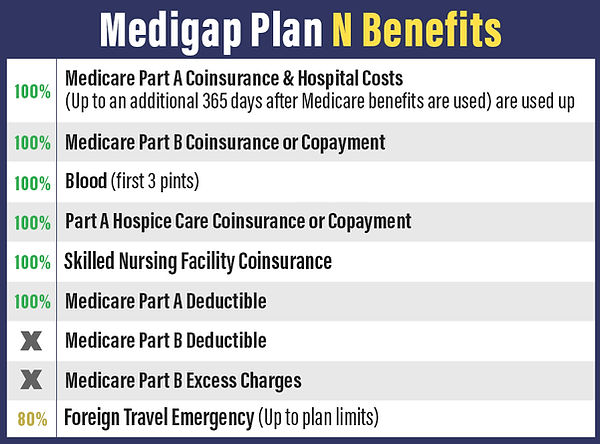

Medigap Plan N

Medigap Plan N is a supplemental policy that save you on your monthly premium by having you pay for your Medicare Part B deductible, excess charges, and some of your copays for doctor's office, and emergency room visits.

What does Medigap Plan N cover?

Medicare Supplement Insurance Plan N covers:

-

Medicare Part A hospital coinsurance and other costs up to an additional 365 dyas after Origianl Medicare benefits are used up

-

Medicare Part A hospice care coinsurance or copayments

-

Medicare Part A deductible

-

Medicare Part B coinsurance or copayments

-

First three pints of blood used in a medical procedure

-

Skilled nursing facility care coinsurance

-

80% of foreign travel emergency care (up to plan limits)

The only thing you pay for regarding your Medicare Part B coinsurance or copayments is you'll pay $20 copay for some doctor's office visits and up to a $50 copay for emergency room visits if you aren't admitted as an inpatient.

What isn't covered under Medicare Supplement Plan N?

Plan N does not cover Medicare part B's deductible or any Part B excess charges. Also, as mentioned, you may have to pay $20 copay for doctor visits and $50 for emergency room visits if you aren't admitted as an inpatient. This allow for full coverage of a lot of other costs you'd normally be on the hook for while also keeping your monthly premium lower than comprehensive medicare supplement plans.

Medicare Supplement Plan N eligibility

Like any other Medigap plan, you are eligible as long as you are enrolled in Medicare Part A and B.

If you are considering a Medicare Supplement, the best time to purchase one is during Medigap's open enrollment period. This window begins on the first day of the month that you are age 65 or over and enrolled in Medicare Part B. During this open enrollment, you are usually guaranteed eligible to enroll in any Medicare supplement insurance plan even if you have pre-existing health conditions. You will also not be charged a high premium for any pre-existing health conditions. The only condition is you have to be enrolled in Original Medicare.

However, you are able to apply for a Medicare Supplement plan at any time. If you are interested in having your Medicare cost-sharing at least partially covered, or even fully covered, a licensed Medicare agent at The Integrity Group can help you find a plan that fits in your budget and health care needs!