Medicare Plan A

Medigap Plan A, or Medicare Supplement Plan A, is a basic Medigap plan that covers the 20% of outpatient medical care Medicare expects you to take care of.

It also provides Medicare Part B coinsurance or copayment coverage and the first three pints of blood you are normally on the hook for.

What is covered under Medicare Supplement Insurance Plan A?

Plan A is the most basic of the 10 Medicare Supplement Insurance plans. However, it covers the most common things Medicare beneficiaries require.

Medigap Plan A covers 100% of the costs associated with these four things:

-

Medicare Part A coinsurance payments for inpatient hospital care for up to an additional 365 days after Medicare benefits are exhausted

-

Medicare Part B copayment or coinsurance expenses

-

The first three pints of blood used in a medical procedure

-

Part A hospice care coinsurance expense or copayment

What is not covered by Medigap Plan A?

Medicare Supplement Plan A policyholders still are on their own to pay Medicare Part A and Part B deductibles. They are also still responsible for their own skilled nursing facility care coinsurance, Part B excess charges, and foreign travel emergency costs. However, Plan A might be the plan of choice for people who don't want to pay higher premiums for benefits they might not use.

Medicare Supplement Insurance Plan A for those Under 65

Medigap Plan A is the supplement available to people under 65 in some states as long as you qualify for Medicare early because of a disability. It is made available for purchase during your open enrollment period without any underwriting.

However, the cost for this plan for people under 65 can be much higher than what a 65-year-old will pay. This is because people who qualify for Medicare due to a disability oftentimes have higher medical costs.

Because of this, it may make more sense for those who are eligible for Medicare because of a disability may be better served by a Medicare Advantage plan. Medicare Advantage plans offer the same rate for anyone regardless of age, gender, or even disability.

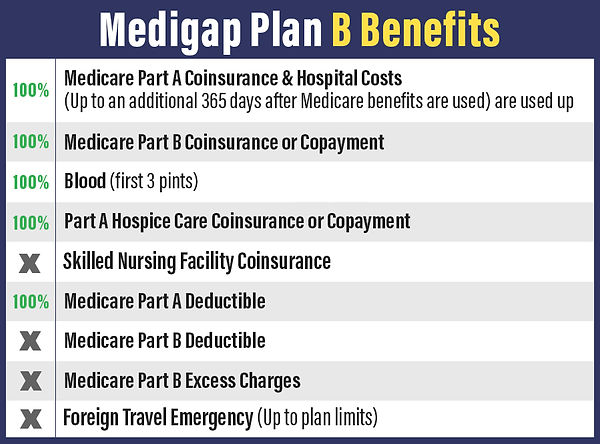

Medigap Plan B

Medigap Plan B offers similar benefits as Plan A but it also includes coverage of Original Medicare's Part A hospital deductible.

Because Part A's hospital deductible isn't an annual deductible, you would be responsible fore paying it multiple times throughout the year without a Medigap plan.

What does Medigap Plan B cover?

As previously states, Medigap Plan B covers everything Medigap plan A does plus your hospital deductible. This means it covers 100% of the costs associated with these four things:

-

Medicare Part A coinsurance payments for inpatient hospital care for up to an additional 365 days after Medicare benefits are exhausted

-

Medicare Part B copayment or coinsurance expenses

-

The first three pints of blood used in a medical procedure

-

Part A hospice care coinsurance expense or copayment

-

Part A hospital deductible

That last point is an important addition as it could save you several extra thousand dollars if you have more than one hospital stay in a year. Ask a licensed Medicare agent at The Integrity Group how much you could save with a Medigap policy.

How do I enroll in Medicare Supplement Plan B?

You can enroll in Medigap plan as soon as your Original Medicare Plan B plan is in effect. Once you meet that requirement, you have six months to enroll in a Medicare Supplement Insurance plan with guaranteed issue.

However, you can enroll anytime. Outside of open enrollment, you only have to answer some simple health questions

How much does Medigap Plan B cost?

Each insurance company that offers a Medigap plan will set their own premium based on the data in their area. This means your zip code, gender, age, tobacco usage, and other factors could affect the premium of your plan.

Because each carrier has to offer standardized coverage with each Medicare Supplement Insurance plan, you hsould choose a carrier that has low rates and a healthy rating. One of our licensed Medicare agents can easily supply you with that information. Just ask!

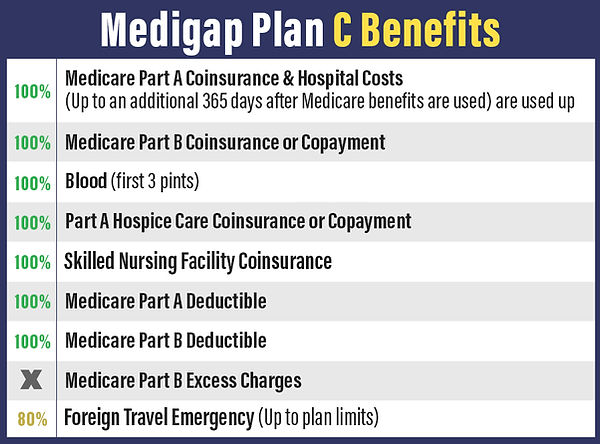

Medigap Plan C

Medigap Plan C is a policy that covers almost all of Original Medicare's copayment and coinsurance requirements. The one exception is Medicare Part B's excess charges - if that is not disallowed in your state.

What does Medicare Supplement Plan C cover?

Medigap Plan C covers nearly all of your copayment and coinsurance requirements. This mean it covers 100% of the costs associated with these four things:

-

Medicare Part A coinsurance payments for inpatient hospital care for up to an additional 365 days after Medicare benefits are exhausted

-

Medicare Part B copayment or coinsurance expenses

-

The first three pints of blood used in a medical procedure

-

Part A hospice care coinsurance expense or copayment

-

Medicare Part A deductible

-

Medicare Part B deductible

-

Skilled Nursing Facility Coinsurance

-

Foreign Travel Emergency

What are Medicare excess charges?

Excess charges are surcharges some states allow your doctor to charge above what Medicare covers. They are limited to 15% beyond Medicare limits. Most doctors don't charge excess charges. If you think you require that coverage, there are other Medigap plans that do provide that type of coverage. A licensed Medicare agent at The Integrity Group can help you find the proper coverage for your needs.

Enrolling in Medigap Plan C

Purchasing a Medicare Supplement policy is easy. Before you apply, you only need to enroll in Original Medicare. Once your Medicare Plan B plan is active, you have a six-month window in which you can purchase a Medigap policy. During this open enrollment window, insurance companies can't raise your premiums due to your health. This is why we always recommend clients enroll in a Medigap policy when they are first eligible.

However, you can enroll at any time, so feel free to ask one of our licensed Medicare agents any questions you have about Medigap or any other Medicare policy!